2025 Set the Stage

2025 was a decisive year for tech, marked by capital concentration and renewed conviction at the top end of the market. In private funding, OpenAI raised a record $40B, while Anthropic and xAI closed multi-billion-dollar rounds that reset valuation ceilings for AI leaders; a growing bench of fast-scaling startups like Perplexity AI, Harvey AI, and Anysphere followed with late-stage raises backed by real usage and ARR. Capital also extended into frontier hardware, with humanoid robotics players Figure AI and Agility Robotics, alongside quantum contender PsiQuantum, attracting sizable rounds as commercialization inched closer. Public markets reinforced the signal: tech stocks led performance, and standout IPOs from CoreWeave, Circle, and Figma debuted at multi-tens-of-billions valuations and traded well, sharpening focus on a high-quality pre-IPO pipeline heading into 2026.

January 2026: Three Events, One Signal

With a landmark IPO filing and two record-shattering AI raises, the year opened with a blitz of activity that signals the pre-IPO market could be entering an era of aggressive acceleration.

Discord Signals IPO Readiness

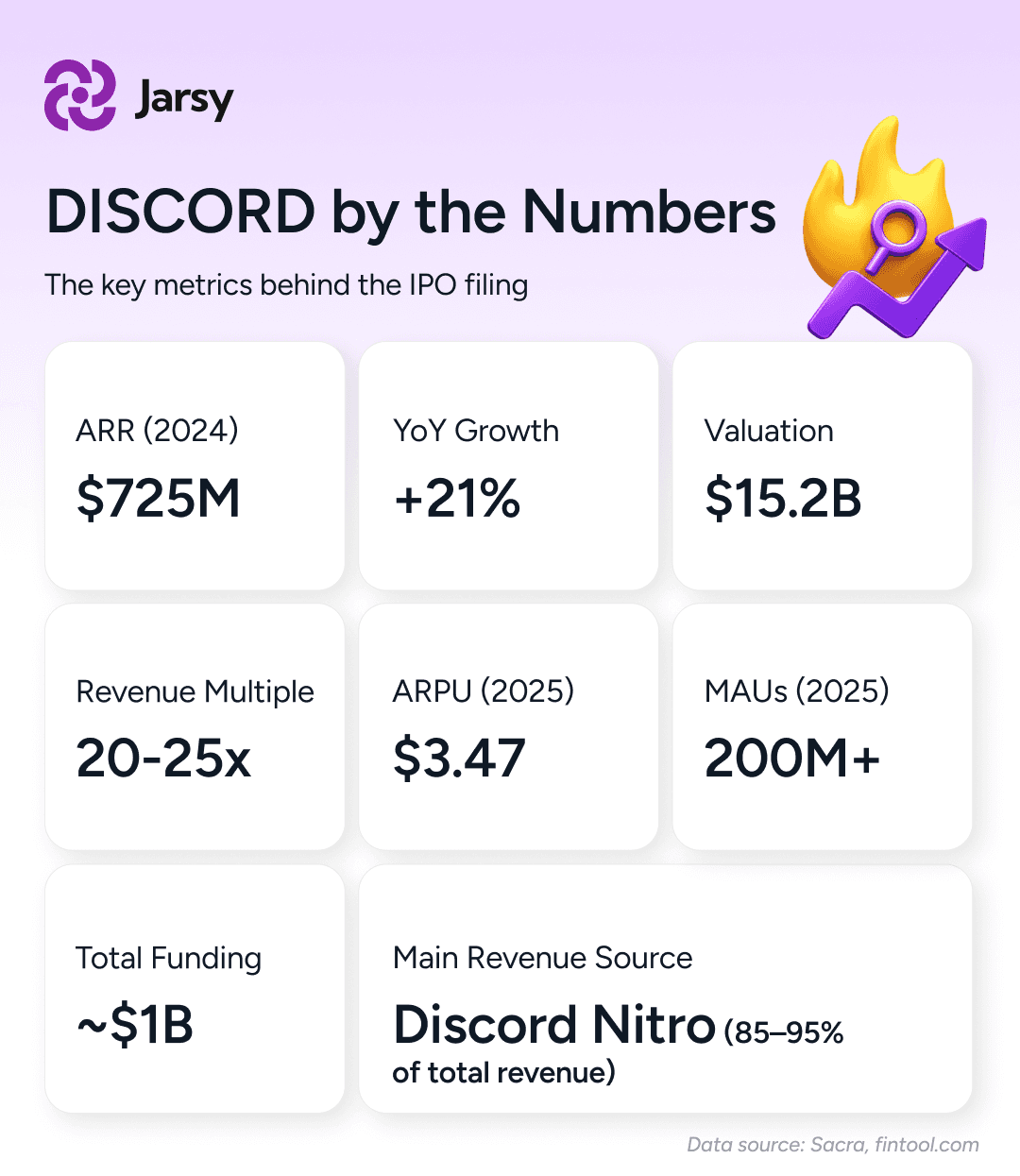

On Jan 7th, according to Bloomberg, Discord confidentially filed paperwork for a U.S. IPO, marking its most concrete step yet toward the public markets. While a confidential filing doesn’t lock in a listing, it typically reflects internal confidence: financials are durable, growth is predictable, and timing feels right.

Copyright © Jarsy Research

Founded in 2015 as a gamer-focused voice chat tool, Discord has evolved into a global real-time community platform with 200+ million monthly active users, spanning gaming, creators, education, and professional groups. Its core innovation - persistent servers with structured text, voice, and video channels - has driven unusually deep engagement and retention by prioritizing ongoing interaction over passive content feeds.

Monetization has followed a disciplined path. Discord’s subscription-led model, anchored by Nitro and server-level premium features, has scaled without heavy reliance on ads. While the company does not disclose full financials, industry estimates place annual revenue in the high hundreds of millions of dollars, supported by recurring subscriptions and strong user willingness to pay for enhanced functionality.

Recent product expansions in video streaming, events, moderation tools, and integrations have further increased utility and stickiness. Together, Discord’s IPO filing reflects a company that has paired creative product evolution with durable engagement and a credible revenue engine, a combination public investors typically reward.

Further reading: Bloomberg Article

xAI Raises Big

xAI kicked off 2026 with one of the largest private funding rounds on record, closing an upsized $20 billion Series E that underscores investor conviction in its full-stack AI strategy. Rather than focusing solely on models, xAI has prioritized infrastructure and distribution at scale, operating the Colossus supercomputer and rapidly expanding data center capacity to support next-generation training for its Grok model family.

Image Credit: xAI

Over the past year, xAI has pushed Grok forward across reasoning, multimodal capabilities, and real-time information access, leveraging deep integration with X to accelerate deployment and iteration. At the same time, the company has invested heavily in compute, reportedly scaling to hundreds of thousands of advanced GPUs and planning further expansion as AI training demands intensify.

Beyond software and infrastructure, xAI has begun signaling longer-term ambitions in hardware optimization, including hiring related to custom silicon development. While still early, that direction suggests a desire to control more of the AI stack end-to-end: from chips to models to distribution.

The scale and intent behind this raise position xAI less like a traditional startup and more like an emerging AI infrastructure platform, built to compete at public-market scale as the AI cycle matures.

Anthropic Pushes Valuation Boundaries

Anthropic entered 2026 in talks to raise roughly $10 billion at an estimated ~$350 billion valuation, nearly doubling its late-2025 valuation following a $13 billion Series F. The sharp step-up, alongside reports that the company is exploring a potential IPO path with outside advisors, reflects growing investor confidence in Anthropic’s long-term position among frontier AI leaders.

Anthropic’s growth has been striking: monthly active usage of its Claude models expanded from just a few million in 2023 to roughly 30 million by mid-2025, alongside a surge in enterprise demand. The company now serves more than 300,000 business customers, up from under 1,000 just a couple of years ago, and has seen its annualized revenue run-rate jump from about $1 billion to over $5 billion in 2025.

Anthropic’s success is rooted in the Claude model family’s focus on predictability, controllability, and safety, which has resonated strongly with enterprise customers, particularly in coding, document analysis, and mission-critical workflows. Products like Claude Code have already contributed significant run-rate revenue, while API usage and enterprise integrations have driven rapid adoption across industries.

This combination of explosive user growth, expanding enterprise footprint, and rapidly scaling revenue underscores why investors are backing Anthropic’s next chapter with such conviction and why it is widely viewed as one of the AI industry’s most significant players as 2026 unfolds.

Further Reading: CNBC Article

Image Credit: Anthropic