This article examines the development of Polymarket and Kalshi, outlining their origins, key milestones, and the role they have played in turning real-world events into tradable markets.

In the final weeks of the 2024 U.S. presidential race, two markets out-performed every pollster in America. On Polymarket, a crypto-based prediction exchange, more than $3.6 billion flowed into bets on whether Donald Trump or Kamala Harris would win, turning a blockchain start-up into an election-night obsession. At the same time, Kalshi, the first CFTC-regulated event-contract exchange, won a court fight in October 2024 that let it list election contracts legally in the United States.

Together they turned politics into a price feed. Polymarket’s odds were quoted on cable news, while Kalshi made it legal for anyone, not just professionals, to trade on political outcomes. For the first time, elections had a live market ticker, and ordinary people were setting the odds.

How They Started

Polymarket, launched in 2020 by New York University dropout Shayne Coplan, is built on the Polygon blockchain and allows users to use USDC to buy and sell “yes” or “no” shares tied to real-world events - elections, sports, economic data, even celebrity news. Each share’s price, from $1 to $0, represents the market’s collective probability that the event will happen or not.

Kalshi, on the other side, took the regulatory route. Founded in 2018 and launched on July 2021 by Tarek Mansour and Luana Lopes Lara, two MIT graduates, it became the first U.S. exchange to win federal approval from the Commodity Futures Trading Commission (CFTC) to list “event contracts”, financial instruments that pay $1 if an event occurs, and $0 if not.

Both of them converge on the same idea: that “Markets seek truth”.

The Origins of Prediction Markets

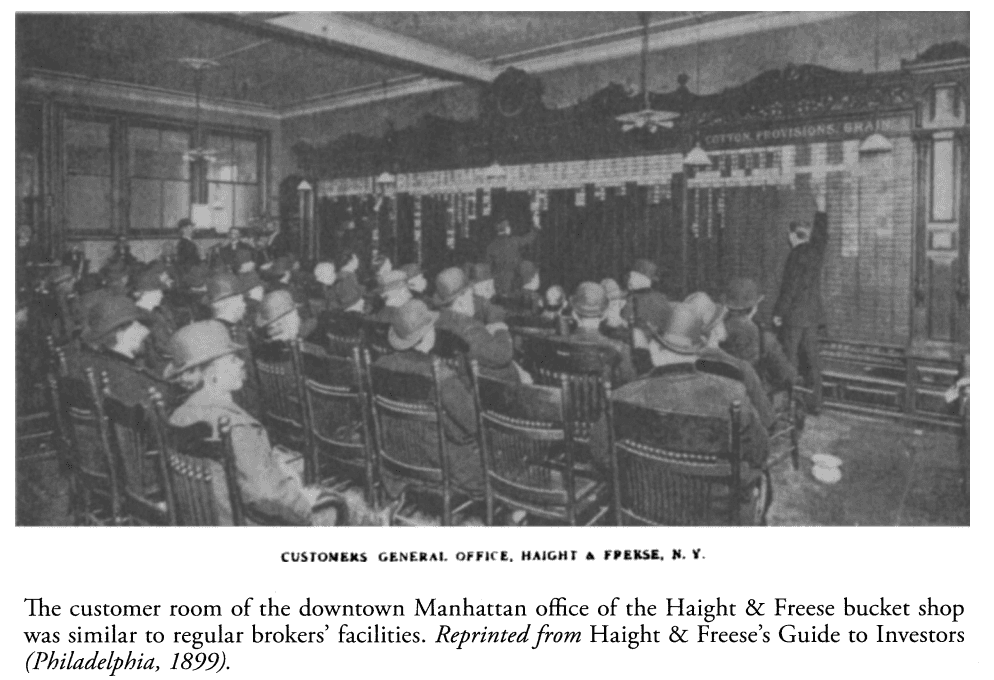

The impulse to bet on the future long predates modern finance. As early as the 16th and 17th centuries, people in Europe were speculating on royal successions and wars in informal betting circles. By the 1880s, Americans were placing “bucket shop” wagers on political outcomes, and by the 1910s, Wall Street operated political betting markets that mirrored today’s exchanges. Newspapers like The New York Times routinely reported betting odds on presidential races, treating them as serious indicators of public sentiment, and they were often right!

Photo Credit: The Journal of American History, Vol. 93, No. 2 (Sep., 2006), pp. 335-358

Yet it wasn’t until Friedrich Hayek’s 1945 essay, “The Use of Knowledge in Society,” that a formal explanation emerged. Hayek argued that prices aren’t just numbers, they’re a mechanism for sharing information, capturing what millions of people know and believe.

Four decades later, economists at the University of Iowa turned that idea into a real experiment. In 1988, they launched the Iowa Electronic Markets (IEM), allowing participants to trade on the outcome of the U.S. presidential election. The IEM’s results were groundbreaking: its price-based forecasts consistently outperformed opinion polls, proving that markets could be not just a measure of belief, but a mechanism for collective intelligence.

Founders from both Polymarket and Kalshi reached the same conclusion long explored by economists: That markets can capture collective knowledge better than experts.

Products and Business Model

On both platforms, Prices = Probabilities. Each share’s price reflects the market’s collective view of how likely an event is to happen. It’s a live forecast set by buyers and sellers, not by the platform. Just as exchanges don’t dictate stock prices, prediction markets don’t dictate odds; they emerge from supply and demand. And because users trade with one another, there’s no “house”, only a market where belief sets the price.

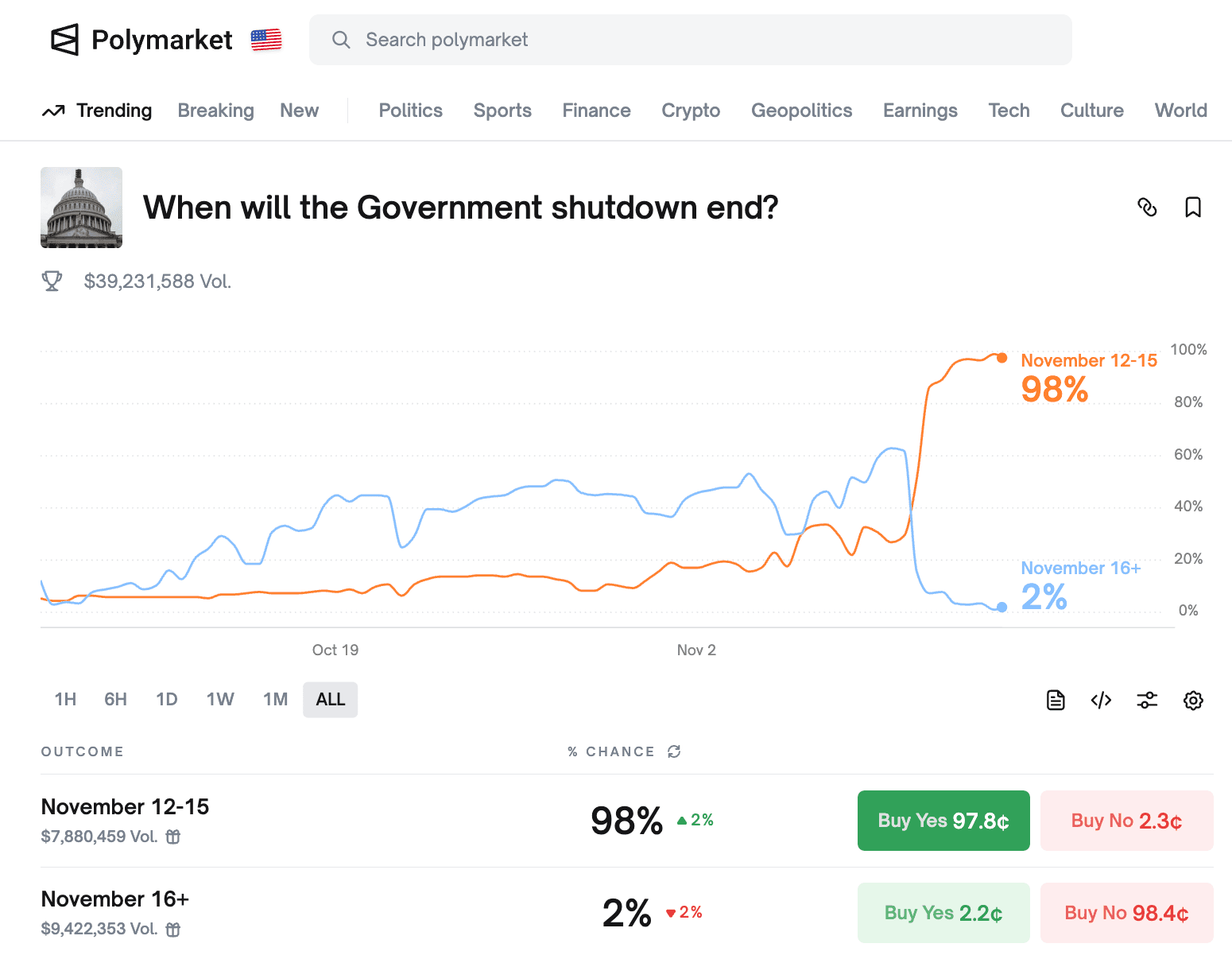

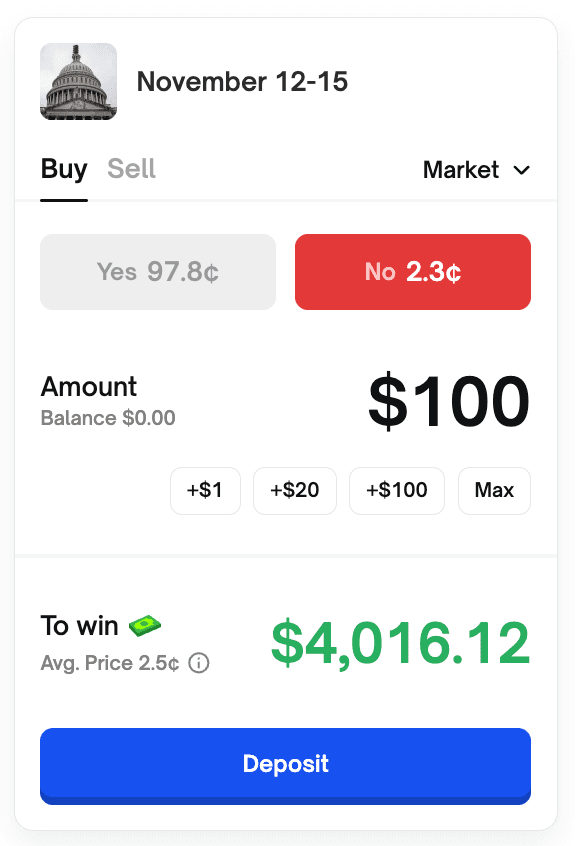

Let's look at an example of a most recent poll: When will the Government shutdown end?

It indicates that, so far, users as a whole are betting on a 98% chance that the government will reopen between November 12 and 15.

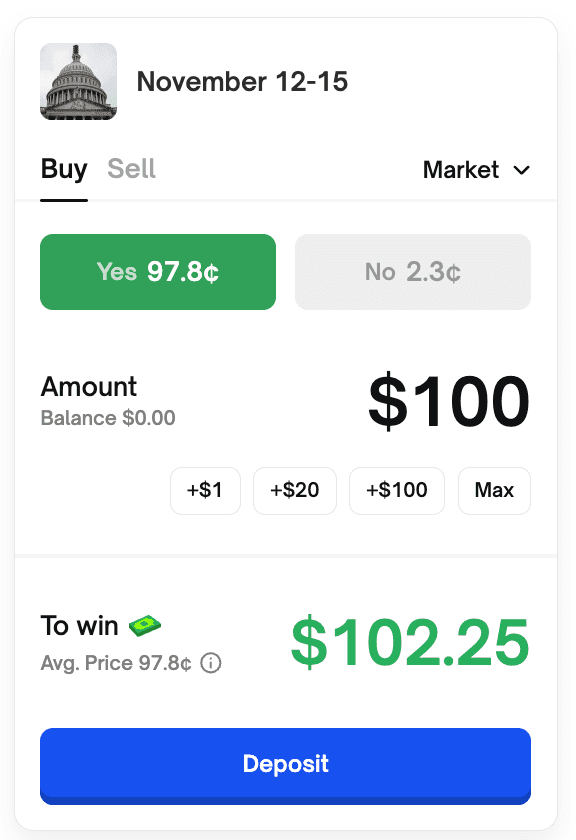

If you believe the reopening will happen within that window, you can buy “Yes” shares for around $0.98 each. Should the government indeed reopen during that period, each share settles at $1.00, earning you a small but highly probable return.

However, if you think the reopening will be delayed, you can buy “Yes” shares on the Nov 16 or later market for about $0.025 per share. If you’re right and the government does reopen after that date, those shares pay out $1.00 each — roughly a 40× payoff on your stake. (see Pictures below)

Although the logic behind both products is similar, the two platforms differ in many ways, with market coverage and fees being among the biggest distinctions. Polymarket has not been available in the U.S. since its 2022 exit, while Kalshi operated exclusively in the U.S. until October 2025. In addition, Polymarket charges no fees for trading or deposits, whereas Kalshi applies fees to most transactions. A detailed comparison is shown in the table below.

Category | Polymarket | Kalshi |

System Type | Decentralised crypto-based market on Polygon (USDC) | Regulated U.S. exchange (DCM* under CFTC) |

Currency | USDC (stablecoin) | U.S. dollars (cash) |

Eligible Regions | 180+ countries excluding US, UK etc, will launch US platform soon | Only US until Oct 2025, then expanded to 140+ countries |

Who you trade with | Other crypto users (peer-to-peer) | Other verified traders (cleared through Kalshi) |

Trading Fees | None | Variable Fee = 0.07 × C × P × (1-P), where C = contracts, P = price (USD). Ranging from 0.07% to 7% |

Maker / Limit Order Fees | None | Mostly none, some category has 0.02% - 0.44% fee, e.g. F1 race or CPI data |

Gas / Network Fees | Yes. Transactions mainly on Polygon. Typical gas on Polygon ≈ 0.001 - 0.01 MATIC ($0.001–$0.01). On Ethereum, can be $5–$50 | None |

Deposit / Withdrawal Fees | None | ACH: None. Wire: Bank fees only. Debit deposit: 2%. Debit withdrawal: $2 flat. |

Settlement | Smart contracts on blockchain | Kalshi Clearing house (CFTC-regulated) |

Primary Revenue | Currently not from trading fees; focuses on ecosystem growth and future data monetisation. | Trading and clearing fees on contracts, similar to futures exchanges. |

Potential Revenue | Data licensing, institutional analytics, fiat on-ramp/off-ramp fees, future U.S. exchange operations. | Market-data sales, institutional market-making, broker partnerships. |

Need KYC? | No in most eligible regions; likely required for upcoming U.S. launch | Yes, ID and Address |

(*DCM = Designated Contract Market; table copyright © Jarsy Research)

Funding and Growth

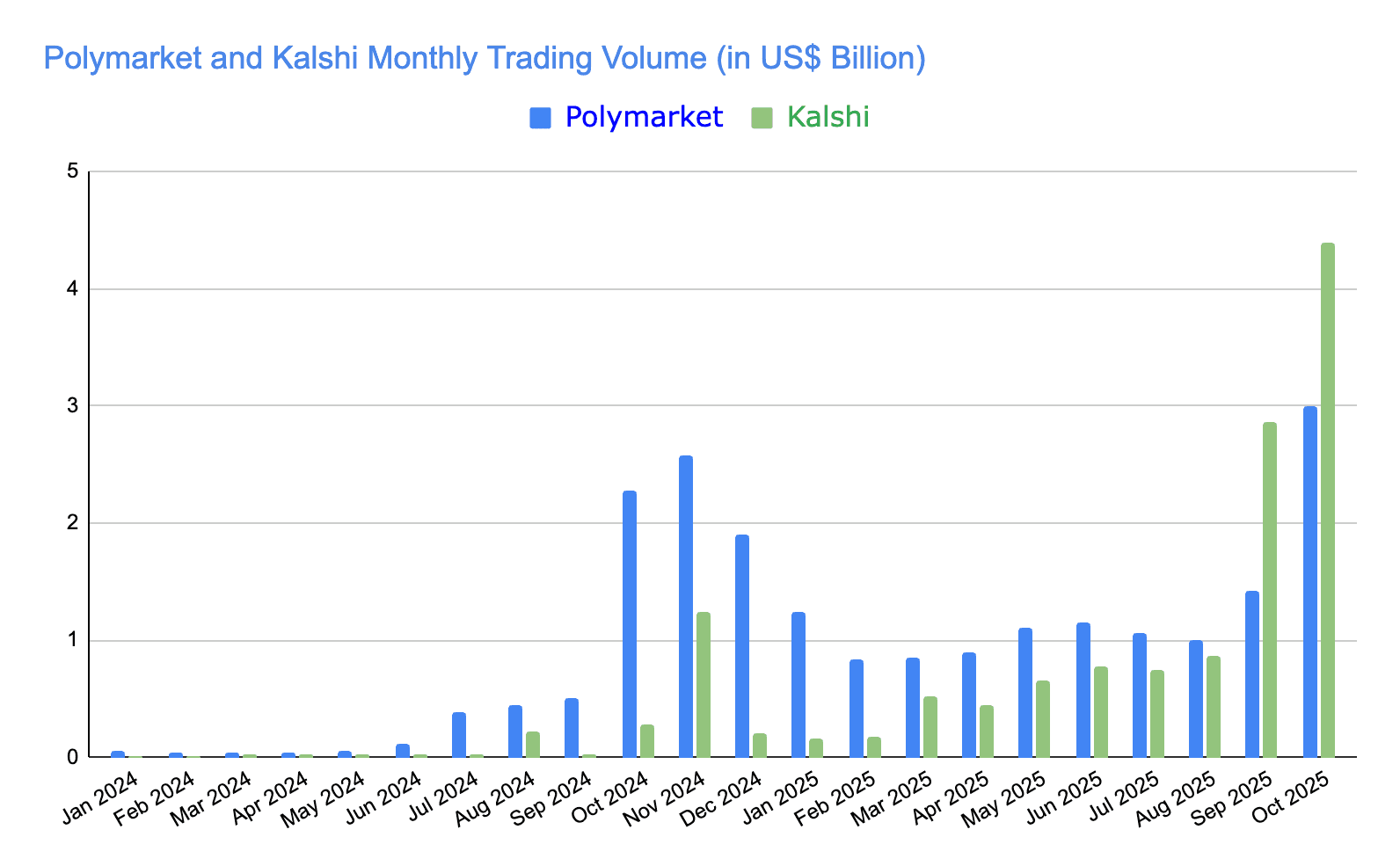

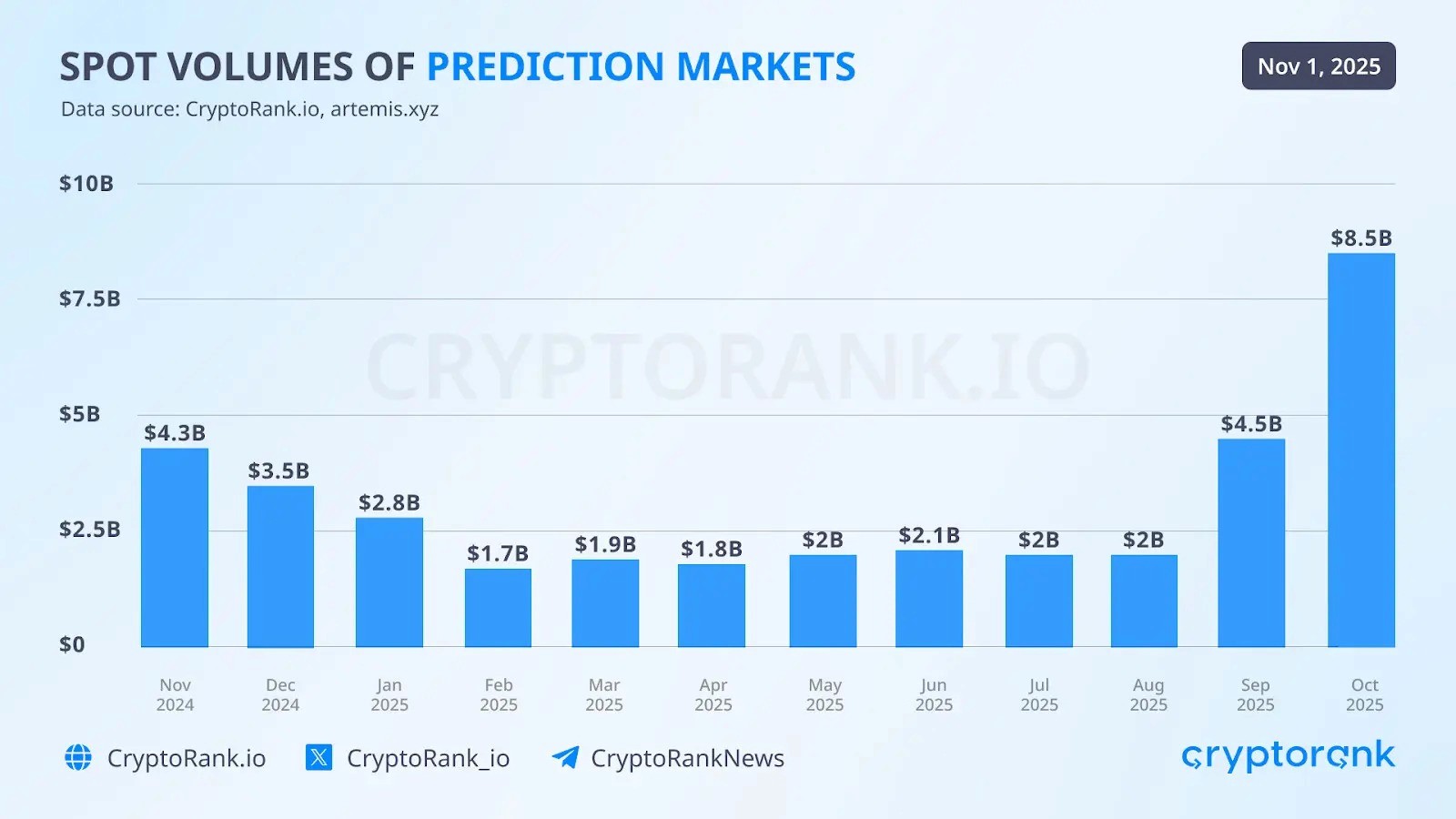

Both Polymarket and Kalshi have seen explosive growth since 2024, driven by the U.S. presidential election and a broader shift toward event-based trading. In October 2025, Polymarket hit a record $3.02 billion in monthly volume, while Kalshi topped it with $4.39 billion. Polymarket continues to lead political markets, while Kalshi has surged in sports, recording about $1.1 billion in sports volume (90%+ of its total volume) during one week of October versus Polymarket’s $357 million. Both platforms have also added major partnerships, including multiyear deals with the NHL; Polymarket later secured another headline partnership as the Official Prediction Market of the UFC. Kalshi further expanded its reach through a broad integration with Robinhood, bringing event contracts to millions of retail traders.

Investor confidence has accelerated alongside adoption. Polymarket’s backers include Founders Fund, Vitalik Buterin, and ICE, whose $2 billion investment supported its U.S. relaunch. Valued at around $9 billion in September 2025, the company is now in talks to raise at a $12–15 billion valuation, according to Bloomberg. Kalshi, backed by Sequoia, Andreessen Horowitz, and Coinbase Ventures, raised $300 million in 2025, lifting its valuation to about $5 billion, with further offers reportedly valuing it higher.

(Data: Dune.com; Chart compiled by Jarsy Research)

(Graph credit: CryptoRank.io)

Outlook

The next phase for both platforms looks promising, driven by clearer regulation and rapidly expanding mainstream adoption. Polymarket is preparing a compliant return to the United States with the backing of ICE’s multibillion dollar commitment, while Kalshi is accelerating its global expansion supported by new investment from leading venture firms. Distribution is widening on both sides, with retail access growing through partners like Robinhood and institutional demand strengthened through ICE’s data network.

Sports markets are now powering much of the recent momentum, driving Kalshi’s fastest growth and becoming more significant on Polymarket, while political markets remain the anchor during election cycles. As regulation stabilizes, both platforms are positioned to expand into macroeconomic, cultural and corporate forecasting. Prediction markets are no longer experimental; they are emerging as a durable layer of financial infrastructure for pricing uncertainty in real time.

Further Reading: Everything’s Casino by Business Insider; The Atlantic Article; October Volume by CoinLaw; The Use of Knowledge in Society by Hayek;