For more than a century, humans have imagined robots that look, move, and even feel like us. Our earliest visions came not from factories or research labs, but from stories: literature and films that explored what might happen when machines become companions, heroes, or even threats.

Some of these stories warm the heart - WALL-E, Big Hero 6, even Astro Boy - each portraying robots as gentle companions who teach us empathy, courage, and kindness. Others push us into deeper reflections and debates about consciousness, free will, the boundaries of humanity, and the limits of control, works like: I, Robot, Ex Machina, Terminator, and Blade Runner.

These stories didn’t just entertain. They rewired our imagination. They lit sparks in the minds of young engineers who would one day build the humanoid robots we see emerging today.

Among those inspired are Elon Musk, who grew up on classic sci-fi and now channels those ideas into Tesla; Brett Adcock, whose childhood robot heroes shaped Figure AI’s mission to build general-purpose humanoids; and Apptronik founders Jeff Cardenas and Nicholas Paine, who carried their early “what if?” wonder into creating robots that can safely work alongside people. These are the dreamers who turned science fiction into real engineering.

In this blog, we take a closer look at the humanoid robots built by these pioneers—how they work, what they’re capable of, and the technological breakthroughs that are pushing the field forward.

The Beginning of Apollo, Figure 03, and Optimus

Before we compare their technology, let’s take a quick look at how each of them began:

Apptronik began inside the Human-Centered Robotics Lab at the University of Texas. For years, the team built advanced exoskeletons and NASA robot systems, and in 2023 they finally revealed Apollo, their first commercial humanoid.

Figure AI was founded in 2022 with a bold mission: build a general-purpose humanoid that can work anywhere humans do. Backed by Microsoft, OpenAI, NVIDIA, and top investors, they’ve moved extraordinarily fast: from their first prototype to the highly capable Figure 03 in just a few years.

Tesla’s Optimus started as an idea Elon Musk announced in 2021: “If we can make a robot that can do work we don’t want to do, we should.” Using Tesla’s proprietary AI and manufacturing expertise, the team built Optimus from the ground up, quickly iterating to the improved Gen-2 robot revealed in late 2023.

Simple Robotics 101 (Kudos to BofA research)

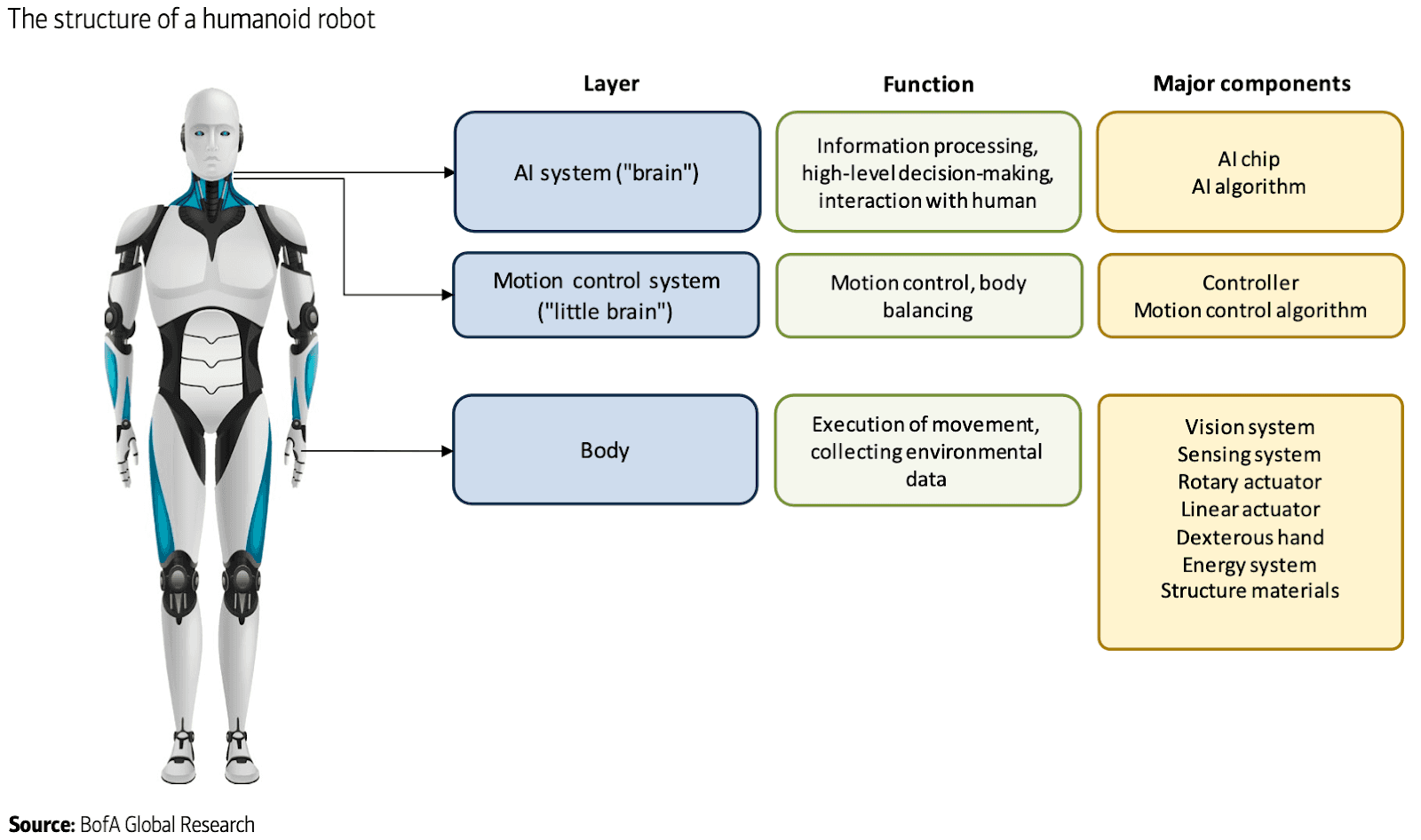

We’d also like to give you a simple Robotics 101, a quick look at a robot’s “body parts.”

The structure of a typical humanoid robot can be divided into three major layers:

AI system

Motion control system

Robot body

1. The AI system is the “brain”, consisting of the AI chip and AI algorithm. It oversees high-level information processing and decision making (including task decomposition, understanding surrounding environment, model inference, etc.), as well as interaction with humans.

• The motion control system is the “little brain”, which includes controllers and motion control algorithms. It is largely in charge of motion coordination, body balancing, and route navigation.

• Lastly, the body, containing hardware used for environmental data collection and execution of movement. The latter includes vision system, sensory system, actuators, dexterous hand, energy system, and structure materials.

Detailed Comparison Between the Three Models

Features & Subsystem | Apollo | Figure 03 | Optimus (Gen-2) |

Weight | 72.6 KG | 61 KG | 57 KG |

Height | 5'8" (172.7 cm) | 5'8" (172.7 cm) | 5'8" (172.7 cm) |

Target Price Range | <$50,000 | $50,000 | ~$20,000 - $30,000 |

Use Cases | Industrial & intralogistics deployment: Manufacturing plants, distribution centers, and warehouses. | General-purpose humanoid: Home, mass manufacturing, world at scale. | Factory use + broader general tasks, including home & facility maintenance. |

Actuator Module | - Mix of custom linear & rotary actuators designed in-house; - Emphasis on serviceability and safety for factory use; - Published payload 25 kg. | - Electric actuators designed in-house; - Figure 03 payload 20 KG. | - Mix of custom linear & rotary actuators designed in-house; - Gen-2 payload around 20 KG. |

Dexterous Hands | - Industrial-grade hands; - specific DoF/tactile layout not disclosed. | - New compliant/tactile hand system on Figure 03; - 16 DoF, adaptive fingertips; - redesigned tactile stack to withstand real-world use. | - New hands with fingertip tactile on all fingers; - 11 DoF per hand; - Able to manipulate fragile objects (egg demo). |

Rotary-actuator integration & Packaging | - Modular joint packs; - Apptronik highlights hot-swappable power and production-ready modules; - Collabs with TI on functional safety, motor control & power around its custom linear/rotary joints. | - Figure 03 is said to be “purpose-built” for their VLA stack, but actuator-electronics integration details aren’t published. | - Public materials call out “actuators-integrated electronics and harnessing” in Gen-2 (cleaner, lighter limbs; 2-DoF neck). |

Vision system & other sensing | - Multi-camera stereo RGB; - Stereo-depth / ToF; - Partial 360° Awareness; - Runtime ~4 h / pack enables continuous ops with swaps; - AI intergration: NVIDIA GR00T ecosystem. | - High-resolution multi-camera; - Stereo-depth; - LiDAR presence varies by prototype; - Near-360° Awareness; - Strong tactile–vision integration; - Support Helix (Figure's proprietary vision-language-action AI). | - Multi-camera (pure vision, Tesla FSD style); - Stereo-depth only (no LiDAR); - Dense fingertips tactile; - Partial 360° Awareness; forward-dominant; - AI intergration: Tesla Vision + Dojo training. |

AI system | Leans into NVIDIA ecosystem (GR00T, Isaac), easing partner integrations, sim-to-real, and rapid model upgrades. | Proprietary Helix stack; strong vertical integration from sensors to policy. | Vertically integrated software + custom electronics; training supply chain now likely more third-party GPU-centric. |

Who Leads in Each Area?

Tesla appears to have a slight advantage in actuators and joint integration, thanks to its tightly packaged, lightweight joints developed with Tesla’s vehicle engineering expertise.

Figure AI leads in vision and dexterous hands, with Figure 03 showing the most advanced camera system, fastest processing, widest field-of-view, and palm cameras for close-up manipulation.

Apptronik has an edge in industrial readiness, offering swappable batteries, easy-to-service joints, and a tailored design for factory safety and reliability.

These differences show each company holds a distinct advantage in its own niche, keeping the humanoid race far from over.

Business Model, Funding, and Partnerships

These three leading companies are taking very different paths in how they build, fund, partner, and scale their robots.

Apptronik is taking the most practical route: selling reliable humanoids directly to factories that need automation right now. Its modular build, swappable batteries, and simple service model give it a clear short-term revenue path. The company raised $403 million in early 2025 at a $1.8 billion valuation and already works with major partners like Mercedes-Benz and GXO Logistics.

Figure AI is following a dual strategy: selling its general-purpose humanoid (Figure 03) to large enterprises, while also building toward recurring software and AI subscription revenue, plus a potential Robot-as-a-Service model in the future. It has the broadest ambition of the three: a humanoid that can handle many tasks and eventually enter consumer settings. Figure raised over $1 billion in its September 2025 Series C at a $39 billion valuation, with BMW as its key commercial partner.

Tesla, in the meantime, is funding Optimus internally and rolling it out inside its own Gigafactories first. With Tesla’s huge manufacturing scale, AI infrastructure, and vertically integrated ecosystem, Optimus could reach unmatched scale once the company chooses to bring it to the wider market.

Future Outlook

Looking ahead, each company is poised to lead in a different vertical:

Apptronik is best positioned for near-term factory adoption

Figure AI is pushing hardest toward high-skill general-purpose capability

Tesla has the greatest potential to dominate at a massive scale.

It’s early, and the most realistic outcome is that each company becomes a leader within its own segment.

Further reading: Humanoid Robots 101 by BofA, Our Investment in Apptronik by Mechanism Captial