Back to All Articles

Cap Tables & Preferred Share Classes Explained: What Investors Need to Know About Pre-IPO Equity

Understand how cap tables, dilution, and preferred share classes shape pre-IPO ownership, risk, and returns. This Jarsy guide explains liquidation preferences, investor rights, SPVs, tokenized equity, and practical due-diligence steps so retail investors can evaluate private-market opportunities with confidence.

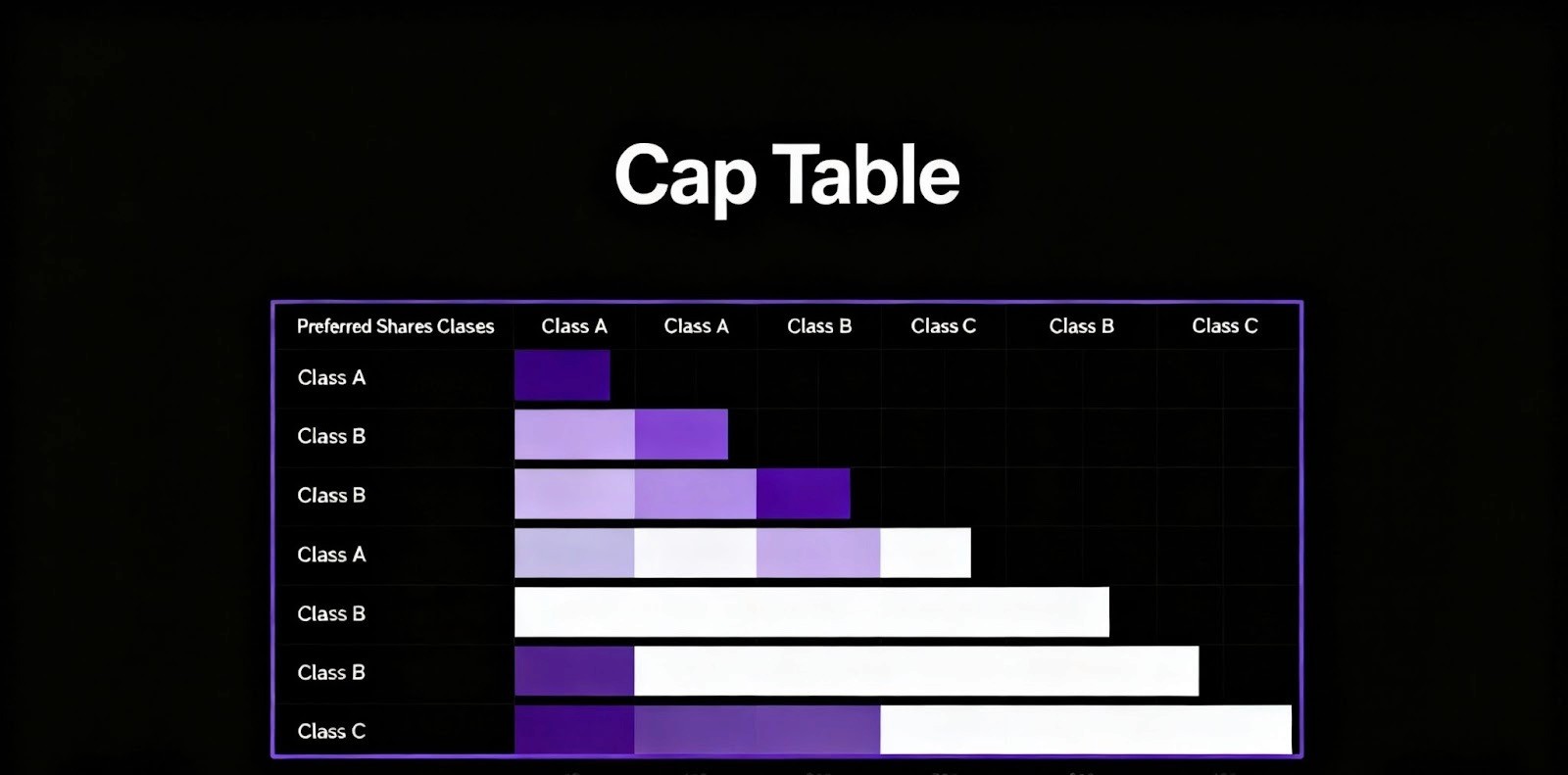

A capitalization table—or cap table—lays out who owns what in a private company, tracking common and preferred shares, options and warrants, and revealing dilution trends that shape valuation and exit outcomes. For retail investors seeking pre-IPO exposure, understanding cap tables and preferred stock classes is critical to gauge ownership, downside protection and potential returns. This guide will cover:

What a cap table is and how to read its components, dilution impact and management importance.

How preferred shares differ from common stock, including liquidation preferences and protective provisions.

The role of cap tables and share classes in pre-IPO pricing, dilution risk and SPV structures.

How tokenized marketplace democratizes access with fractionalized preferred shares on blockchain.

Practical steps for due diligence, portfolio diversification.

What Is a Capitalization Table and Why Is It Important for Investors?

A capitalization table is a detailed ledger of a company’s equity securities, mapping each stakeholder’s ownership share and highlighting how new funding or option grants dilute existing positions. By showing pre-money and post-money stakes, it enables investors to assess their percentage ownership, potential dilution trajectories and ultimate exit returns. Understanding a cap table underpins valuation analysis and informs negotiation of protective terms.

What Are the Key Components of a Startup Capitalization Table?

A cap table typically lists every class of equity—common stock, preferred stock, options and warrants—alongside conversion rights, exercise prices and fully diluted share counts.

Security Type | Characteristic | Role |

|---|---|---|

Common Stock | Basic ownership class with voting rights | Reflects founder, employee and early investor stakes |

Preferred Stock | Equity with special rights and preferences | Provides dividend and liquidation priority |

Options & Warrants | Rights to purchase shares at predetermined price | Incentivizes employees and preserves funding flexibility |

Each line item clarifies how shares convert, how many shares remain reserved for incentives and how dilution unfolds over successive financing rounds, setting the stage for accurate ownership and return estimates.

How Do You Read and Interpret a Cap Table?

Reading a cap table begins with identifying total authorized shares, issued shares by class and reserved pools. Ownership percentage = (shares held ÷ fully diluted shares) × 100. Sorting rows by investor or employee reveals stake size; columns for conversion ratios and liquidation preferences flag seniority and downside protection. Interpreting these elements guides investors in projecting exit proceeds under various scenarios, bridging cap table structure with valuation models.

How Does Dilution Affect Ownership on a Cap Table?

Dilution occurs when a company issues additional shares—via new funding, option exercises or warrant conversions—reducing each existing holder’s percentage stake. While dilution can fund growth and increase absolute value of a share, retail investors must model dilution curves across Series A, B and beyond to validate whether ownership retention justifies potential ROI. Examining pre- and post-round cap table snapshots highlights dilution impact and informs investment sizing.

Why Is Cap Table Management Critical for Pre-IPO Investors?

Accurate cap table management ensures that share counts, conversion clauses and reserved pools stay current, avoiding surprises during an exit. For pre-IPO investors, reliable cap tables are the backbone of transparency: they confirm tokenized share backing, validate liquidation waterfalls and guarantee that fractional holdings reflect real economic rights. A well-maintained cap table fosters trust and smooth exit execution.

What Are Preferred Shares and How Do They Differ from Common Stock?

Preferred shares are a senior equity class granting investors priority in dividends and liquidation proceeds, often in exchange for limited voting rights. Unlike common stock, which offers a residual claim and full voting power, preferred stock embeds protective provisions that shield investors from downside scenarios and ensure minimum returns before common holders share proceeds.

What Are the Main Differences Between Preferred Stock and Common Stock?

Preferred stock may grant dividends (which can be fixed, cumulative, or discretionary depending on terms), liquidation preference, and conversion rights into common shares, whereas common stock generally carries voting rights and residual upside.

Feature | Preferred Stock | Common Stock |

|---|---|---|

Dividend | Fixed or cumulative dividends | Variable dividends, if declared |

Liquidation Preference | 1× or multiple preference before common proceeds | Receives only leftover funds |

Voting Rights | Often limited or non-voting | Full voting power on corporate matters |

Conversion | Convertible into common at set ratios | Non-convertible |

Differences Between Preferred Stock vs. Common Stock & Share Dilution: What Causes Dilution & How to Prepare

Preferred stock offers expanded rights and liquidation preferences to shareholders, making it less risky than common stock by granting primary access to company assets during a liquidity event. Share dilution occurs when a company issues new shares, reducing existing shareholders' ownership percentage and potentially impacting earnings per share and voting power. While dilution can fund growth, investors must assess its impact across funding rounds.This information from Carta supports the article's detailed comparison of preferred and common stock, highlighting their distinct features and the critical impact of dilution on investor ownership and returns in pre-IPO companies.

What Types of Preferred Shares Exist in Pre-IPO Companies?

Pre-IPO firms commonly issue:

Series A Preferred – Early institutional round with 1× liquidation preference.

Series B Preferred – Growth-stage shares with anti-dilution protections.

Convertible Preferred – Automatically convert into common at IPO.

Participating Preferred – Double-dips: preference plus pro rata share.

Non-Participating Preferred – Choice between fixed preference or conversion.

These share classes balance investor protections with founder incentives and evolve as companies progress through funding stages.

How Do Liquidation Preferences Work and Protect Investors?

Liquidation preferences dictate exit proceeds distribution: a 1× preference returns the original investment before common shareholders participate. Participating preferred adds a second layer of proceeds share, while non-participating holders choose between preference or conversion. For example, if Series A investors contribute $5M with a 1× non-participating preference, they recover up to $5M before common equity holders participate—unless they choose to convert into common stock if conversion yields a higher return.

Understanding Liquidation Preference in Venture Capital

Liquidation preference is a critical term in venture capital agreements that dictates the payout order to investors during a liquidity event, such as a merger, acquisition, or IPO. This mechanism ensures that investors recoup their initial investment before other equity holders receive distributions, serving as a strategic provision to protect investors and influence the financial landscape of a startup.This research directly supports the article's explanation of how liquidation preferences function to protect investors by prioritizing their returns in exit scenarios.

What Are Protective Provisions and Investor Rights in Preferred Shares?

Preferred shares often include:

Anti-Dilution Clauses – Full ratchet or weighted average adjustments guard against down rounds.

Voting Rights – Consent requirements for major corporate actions (e.g., new share issuance).

Conversion Rights – Automatic or optional conversion to common shares at IPO.

Redemption Rights – Company obligation to repurchase shares after specified dates.

These provisions collectively secure investor capital, maintain governance influence and align exit incentives.

How Do Cap Tables and Preferred Shares Influence Pre-IPO Investment Decisions?

Cap tables and share classes directly shape pre-IPO share pricing, perceived risk and expected exit multiples. By analyzing ownership stakes and preference hierarchies, investors can derive implied valuations, estimate dilution scenarios and compare economic returns across funding rounds.

How Does a Cap Table Affect Pre-IPO Share Valuation and Pricing?

Cap tables inform pre-money and post-money valuations by linking new investment amounts to share price: Price per share = Pre-money valuation ÷ Fully diluted shares. A clear cap table ensures investors know exactly how many shares they receive at each price, enabling fair pricing and accurate valuation multiples.

What Is the Impact of Dilution on Retail Investors in Pre-IPO Rounds?

Dilution reduces percentage ownership but can raise absolute share value if new capital accelerates growth. Retail investors must assess how successive financing rounds—Series A, B, C—erode ownership and recalculate break-even and target exit multiples, balancing dilution risk against potential valuation uplifts.

What Role Do Special Purpose Vehicles (SPVs) Play in Simplifying Cap Tables?

SPVs pool multiple retail investors into a single legal entity holding shares on their behalf, presenting just one line on the cap table. This simplifies cap table management for issuers and grants retail participants proportional ownership via fractional tokens, maintaining clear equity records and easing administrative burdens.

Special Purpose Vehicle Companies for VC and Startups

Special Purpose Vehicles (SPVs) are legal entities created to pool funds from multiple investors for a single company or project, thereby isolating financial risk. They offer startups access to larger pools of capital and simplify their capital structure by consolidating numerous individual investors into one entity. For investors, SPVs provide risk mitigation, diversification, and access to exclusive deals.This source validates the article's discussion on the role of SPVs in simplifying cap tables and democratizing access to pre-IPO investments for retail investors.

What Are the Risks and Rewards of Investing in Preferred Pre-IPO Shares?

Preferred pre-IPO investments can offer downside protection through liquidation preferences and sometimes anti-dilution rights, along with potential upside through conversion at IPO, although actual protections vary by deal terms. However, risks include extended lock-up periods, valuation uncertainty and dependency on subsequent funding or exit timing. Weighing these factors against return potential is key.

What Practical Steps Should Investors Take When Evaluating Cap Tables and Preferred Shares?

A disciplined, structured due diligence process helps investors confidently assess ownership structures, rights and return scenarios before committing capital.

How to Perform Due Diligence on Pre-IPO Cap Tables and Financials?

Review the full cap table history, examine conversion terms, liquidation waterfalls and reserved pools. Validate that tokenized share records match SPV filings and assess financial statements for runway, burn rate and valuation milestones.

What Common Questions About Cap Tables and Preferred Share Classes?

Investors often seek concise clarifications on equity structures and term implications to inform pre-IPO decisions.

What Is a Cap Table and Why Is It Important?

A cap table is a comprehensive record of all equity stakeholders and securities in a private company, crucial for understanding ownership percentages, dilution trends and exit returns.

What Are Preferred Shares in a Startup?

Preferred shares are an equity class with priority claims on dividends and liquidation proceeds, often including anti-dilution and conversion rights to safeguard investor capital.

How Does Liquidation Preference Affect Investors?

Liquidation preference ensures that preferred shareholders recoup their investment—typically 1×—before common shareholders receive any exit proceeds, reducing downside risk.

What Is the Difference Between Common and Preferred Stock?

Preferred stock offers fixed or cumulative dividends and senior claims on assets, while common stock carries voting rights and residual upside without guaranteed preference in exits.

How Do Cap Tables and Preferred Shares Evolve During Startup Funding and Exit Events?

Cap tables and share classes adjust through each funding round and convert or distribute according to preference terms at IPO or acquisition.

How Do Funding Rounds Affect Cap Table Ownership and Dilution?

Each round issues new shares at negotiated prices, increasing total share count and diluting existing holdings unless anti-dilution clauses adjust conversion ratios. Tracking series-by-series cap table snapshots reveals true post-round ownership stakes.

What Happens to Preferred Shares During an IPO or Acquisition?

Preferred shares often convert into common stock before an IPO, typically at a predetermined conversion ratio (commonly 1:1, though subject to adjustments based on terms). In acquisitions, liquidation preferences dictate exit waterfall order, with any conversion choice based on which yields higher proceeds.

How Are Liquidation Preferences Applied in Exit Waterfalls?

A waterfall sequence distributes exit proceeds first to preferred shareholders up to their preference multiple, then converts remaining proceeds proportionally among common and converted preferred holders. This structure balances downside protection with shared upside.

Investors equipped with cap table literacy and a clear grasp of preferred share mechanics can confidently navigate pre-IPO opportunities.

Frequently Asked Questions

What are the benefits of investing in preferred shares compared to common shares?

Investing in preferred shares offers several advantages over common shares. Preferred shareholders typically receive fixed dividends, which can provide a more stable income stream. Additionally, they have priority over common shareholders in the event of liquidation, meaning they are paid first. This downside protection can be crucial during financial downturns. Furthermore, preferred shares often come with conversion rights, allowing investors to convert their shares into common stock under favorable conditions, potentially enhancing their returns if the company performs well.

How can investors assess the risk of dilution in pre-IPO investments?

To assess dilution risk in pre-IPO investments, investors should closely examine the cap table and understand the company's funding history. They should look for the number of shares issued in previous rounds and the terms of any anti-dilution provisions. Additionally, modeling potential future funding rounds can help investors estimate how their ownership percentage may change. Understanding the company's growth trajectory and capital needs is also essential, as this will influence the likelihood and impact of future dilution on their investment.

What role do anti-dilution provisions play in protecting investors?

Anti-dilution provisions are critical for protecting investors from the adverse effects of dilution during subsequent funding rounds. These provisions adjust the conversion price of preferred shares to maintain the investor's ownership percentage when new shares are issued at a lower price. There are two main types: full ratchet, which adjusts the price to the lowest price of new shares, and weighted average, which considers the number of shares issued. By including these clauses, investors can safeguard their investments against value erosion as the company raises additional capital.

How does the tokenization of shares impact liquidity for investors?

Tokenization of shares significantly enhances liquidity for investors by allowing fractional ownership and easier transferability of shares. By converting traditional equity into blockchain-based tokens, investors can buy and sell smaller portions of shares, making it more accessible for retail investors. This fractionalization lowers the barrier to entry, enabling investments from as little as $10. Additionally, the transparent and secure nature of blockchain technology facilitates quicker transactions and reduces the administrative burden associated with traditional share transfers, ultimately improving market efficiency.

What should investors look for in a cap table during due diligence?

During due diligence, investors should scrutinize several key elements of a cap table. They should check the total number of authorized and issued shares, the breakdown of share classes, and any outstanding options or warrants. Understanding the conversion rights and liquidation preferences associated with each class is crucial. Additionally, investors should assess the historical changes in the cap table to identify trends in dilution and ownership shifts. This comprehensive analysis helps investors gauge the company's financial health and potential return on investment.

What are the implications of liquidation preferences for common shareholders?

Liquidation preferences primarily benefit preferred shareholders, but they also have significant implications for common shareholders. In the event of a liquidation event, preferred shareholders are paid first according to their preference terms, which can limit the amount available for common shareholders. If the company's assets are insufficient to cover the liquidation preferences, common shareholders may receive little to no return. Therefore, understanding the liquidation structure is essential for common shareholders to assess their potential risks and rewards in an exit scenario.