A New Approach to Banking for Startups

Mercury is a software-first financial platform that provides modern banking and financial operations tools for startups, small businesses, high growth companies, and individuals. Founded in 2017 by Immad Akhund and his former Heyzap colleagues Max Tagher and Jason Zhang, Mercury grew out of Immad’s extensive experience as a serial founder, his third startup across eleven years, which exposed him to the persistent pain of opening accounts and managing day to day finances as a startup. Rather than building just another online bank, the team set out to reinvent business banking altogether, addressing the outdated and frustrating processes that plagued founders, including slow onboarding, required branch visits, and endless paperwork.

After securing a $6 million seed round funding from Andreessen Horowitz in Aug 2017, the team set out to build a “minimum delightful product”, the smallest version of a banking platform founders would genuinely enjoy using. Over 18 months, a small engineering team built automated onboarding, modern dashboards, an API-first infrastructure, and banking partnerships robust enough to support real FDIC-insured accounts. When Mercury launched in 2019, it immediately felt like a bank designed by people who understood startup pain firsthand.

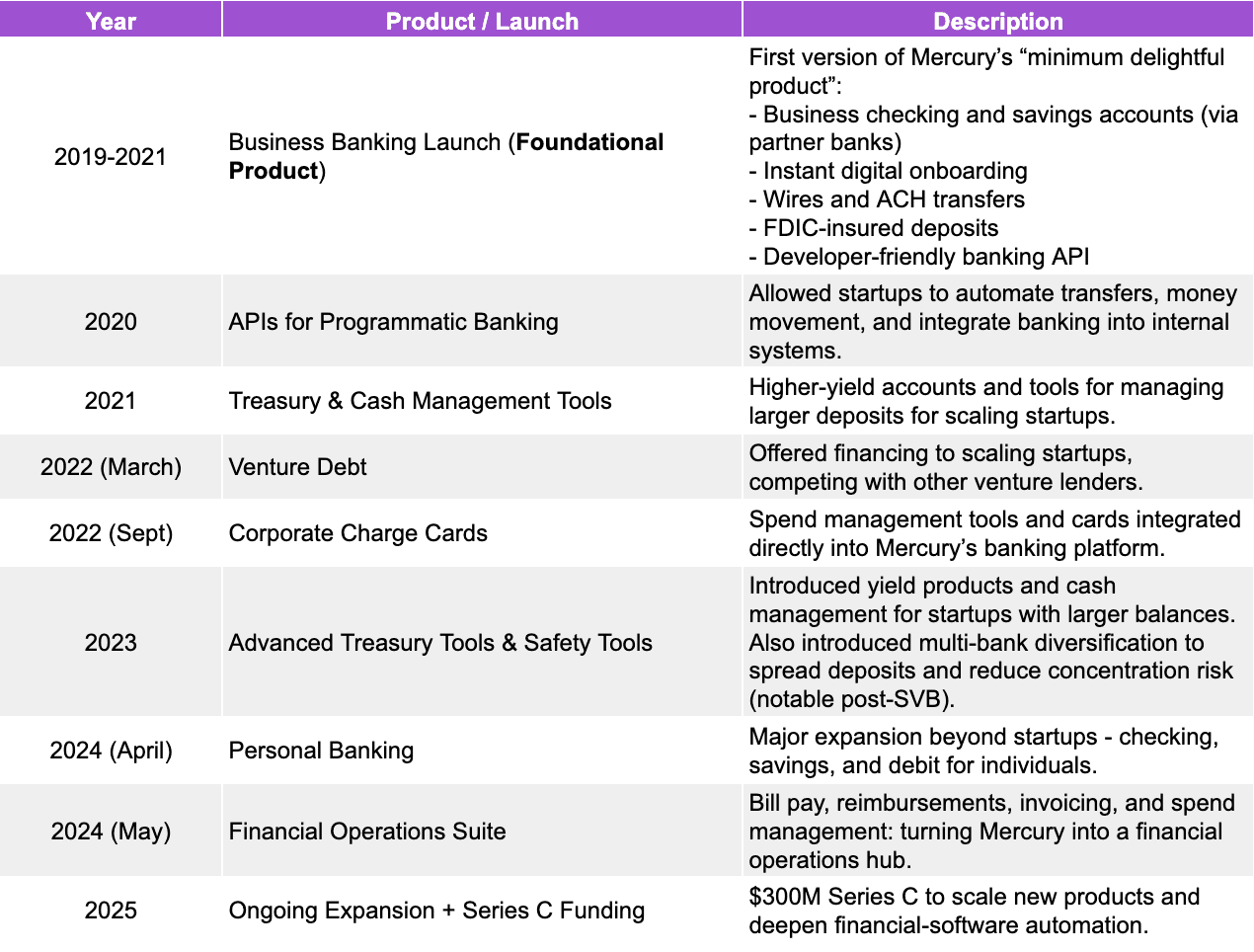

Mercury’s Product Evolution and Expansion Timeline

Mercury has rapidly expanded from its 2019 debut as a digital-first business bank into a full financial operating system for startups. Beginning with simple checking, savings, and seamless onboarding, it quickly added APIs, international wires, venture debt (2022), corporate charge cards (2022), treasury products (2023), and then broadened into financial-ops tools like bill pay, reimbursements, invoicing, and spend management (2024). By 2024-2025, Mercury had also moved beyond startups, launching consumer banking and strengthening its position as a comprehensive platform for managing money, payments, and financial operations across modern businesses. Below are the detailed product launches and their timelines.

Copyright © Jarsy Research

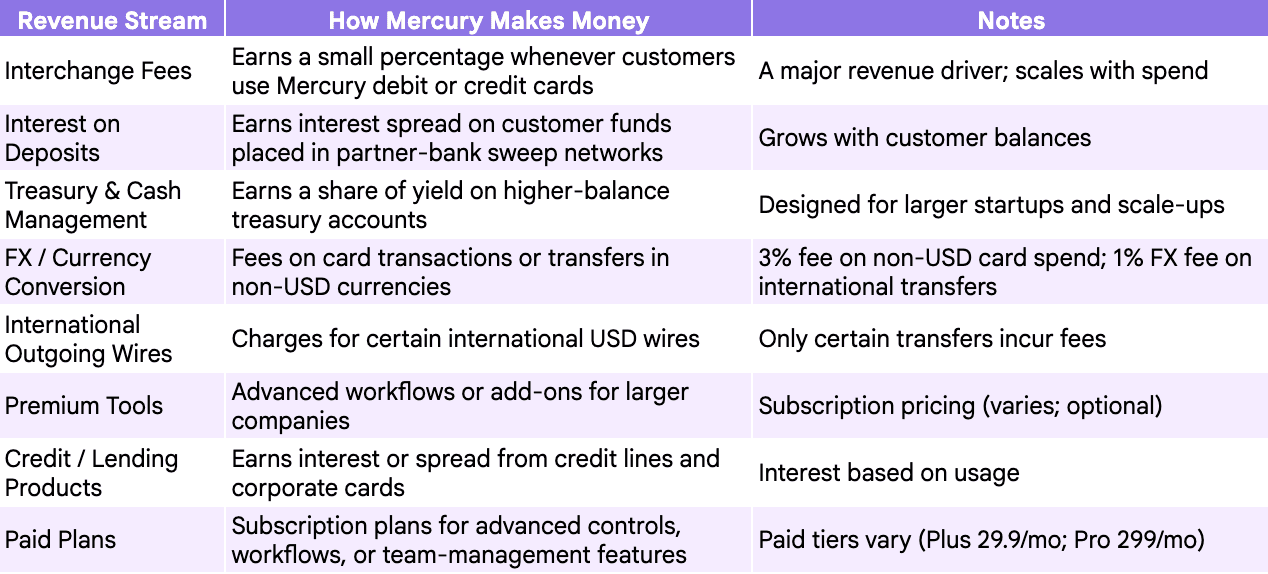

Mercury’s Business Model

Mercury runs a software first banking model where core services such as business accounts, ACH transfers, debit cards, and its dashboard are free, while revenue comes from interchange fees on card spending, interest earned on customer deposits, treasury yield spreads, foreign exchange and international wire fees, and optional paid plans for advanced financial tools. This approach allows Mercury to stay founder friendly while growing revenue as customers increase their balances and financial activity. (Mercury currently is only available for US incorporated businesses)

Copyright © Jarsy Research

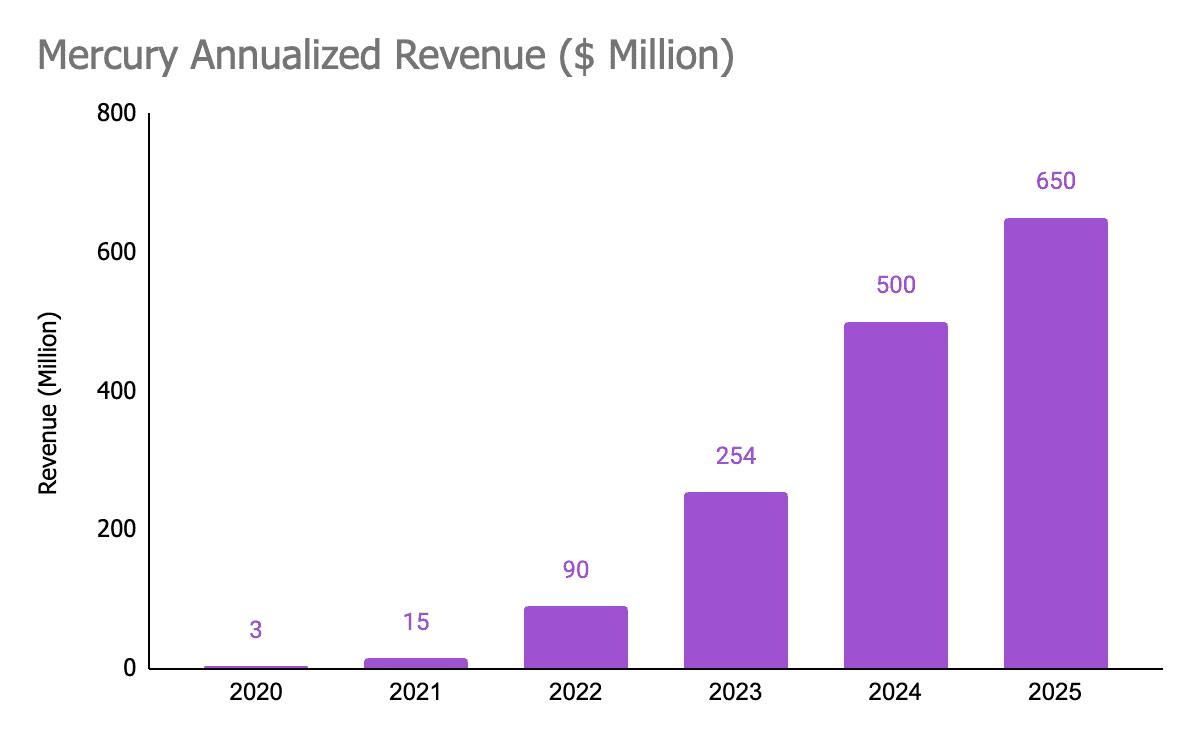

Mercury’s Rapid Growth and Market Momentum

Beginning in 2020, Mercury entered a period of rapid expansion as more startups and small businesses adopted the platform. Its growth accelerated even further in 2023, when the collapse of Silicon Valley Bank sent shockwaves through the startup ecosystem and prompted over 8,000 new companies and more than $2 billion in deposits to move to Mercury within days. By 2024, the company had passed 100,000 customers, and reached about $500 million in annualized revenue, all while maintaining a multi-quarter streak of profitability. That momentum carried into 2025, when Mercury surpassed 200,000 customers and grew annualized revenue to roughly $650 million, reinforcing its position as one of the fastest-scaling and most consistently profitable financial platforms built for modern businesses. This strong and steady performance helped push its valuation from about $1.6 billion in 2021 to $3.5 billion in 2025, when it closed a $300 million Series C, marking Mercury as one of the fastest-growing financial platforms of the decade.

Data Source: Sacra.com

Overall, Mercury stands as one of the leading banking platforms tailored for startups and small to midsize businesses. In a competitive field that includes Brex, Ramp, Relay, Bluevine, and Rho, Mercury’s edge comes from its banking-first focus, clean product experience, and strong reputation among founders. Its fast onboarding, reliable infrastructure, and developer-friendly approach continue to resonate with young, growing companies. Looking ahead, Mercury’s clarity of purpose and sustained performance position it well to deepen its capabilities and solidify its role as the go-to financial platform for modern startups and SMEs.